Not for distribution to U.S. Newswire Services or for dissemination in the United States.

INDIVA Corporation Completes Reverse Takeover Acquisition and Concurrent Financing

LONDON, ON – (December 15, 2017): INDIVA Limited (the “Company“, formerly Rainmaker Resources Ltd.)

(TSX-V:NDVA) is pleased to announce it has closed its previously announced acquisition of 100% of the issued and outstanding securities of Indiva Corporation (“Indiva“) by way of a “three-cornered” statutory amalgamation of Indiva and a wholly-owned subsidiary of the Company (the “Acquisition“). The Company will carry on the medical cannabis business of Indiva following completion of the Acquisition.

In connection with the closing of the Acquisition, the net proceeds of the Company’s previously announced private placement in support of the Acquisition (the “Offering“) have been released to the Company from escrow. Immediately prior to the closing of the Acquisition, the Company completed a consolidation of its common shares (the “Consolidation“) on the basis of 10.878 pre-Consolidation common shares to one (1) post-Consolidation common share (each post-Consolidation common share, a “Common Share“), changed its name from “Rainmaker Resources Ltd.” to “Indiva Limited”, and continued under the Business Corporations Act (Ontario) in the Province of Ontario.

The Company issued 43,540,000 Common Shares to the holders of securities of Indiva at an ascribed price of $0.75 per Common Share after giving effect to the Consolidation, for aggregate consideration of $32,655,000.

The Acquisition constitutes a Reverse Takeover and Change of Business within the meaning of the TSX Venture Exchange (“TSXV“) policies. In connection with the Acquisition, the Company has filed a filing statement dated November 29, 2017 (the “Filing Statement“). More information about the Acquisition, as well as additional disclosure about Indiva, can be obtained from the Company’s Filing Statement filed on SEDAR at www.sedar.com.

Conversion of Subscription Receipts

Pursuant to an agency agreement dated August 28, 2017 (the “Agency Agreement“), among the Company, Indiva and Sunel Securities Inc. (the “Agent“), the Agent agreed to act as exclusive agent to the Company to arrange for the sale of up to 20,000,000 subscription receipts (each, a “Subscription Receipt“) for aggregate gross proceeds of up to $15,000,000 on a “best efforts” private placement basis. 16,073,085 Subscription Receipts were issued under the Offering for aggregate gross proceeds of $12,054,813.75.

Each Subscription Receipt has been automatically exchanged, without any further action by the holder thereof and for no additional consideration, for one unit (a “Unit“) of the Company. Each Unit consists of one Common Share and one-half of one common share purchase warrant (each whole warrant, a “Warrant“). Each Warrant entitles the holder thereof to acquire one Common Share (a “Warrant Share“) for an exercise price of $0.90 per Warrant Share for a period of 24 months from the issuance of such Warrant.

Following the satisfaction of certain conditions precedent, proceeds of the Offering, less the Agent’s commission and certain expenses, have been delivered to the Company pursuant to an amended and restated subscription receipt agreement among the Company, Computershare Trust Company of Canada, the Agent, and Indiva dated November 2, 2017.

The Agent received a cash commission of $315,000 and 420,000 broker warrants (“Broker Warrants“) that entitle the Agent to acquire one Common Share at a price of $0.75 as commission for $7,500,000 of the proceeds of the Offering. The Agent received a cash commission of 7% of the gross proceeds and Broker Warrants equal to 7% of the Subscription Receipts issued on the proceeds of the Offering above $7,500,000.

Convertible Debenture Financing

The Offering was completed concurrently with the offering (the “Convertible Debenture Financing“) of 10% senior convertible debentures (“Convertible Debentures“) of Indiva at a price of Cdn. $1,000 per Convertible Debenture for aggregate gross proceeds of $7,500,000 (the “Escrowed Debenture Proceeds“). Concurrently with the release of the gross proceeds of the Offering, the Escrowed Debenture Proceeds have been delivered to the Company.

Additionally, the Company has closed a second tranche of the Convertible Debenture Financing, issuing additional Convertible Debentures in the principal amount of $3,500,000. This brings the aggregate gross proceeds to the Company from the Convertible Debenture Financing to $11,000,000.

The Convertible Debentures were issued pursuant to an agency agreement among Indiva and PI Financial Corp. (“PI“) dated November 3, 2017 (the “Debt Agency Agreement“). Pursuant to the terms of the Debt Agency Agreement, PI received a cash commission and Broker Warrants equal to 7% of the gross proceeds of the Convertible Debenture Financing.

Board of Directors

The board of directors of the Company will initially consist of Niel Marotta, Koby Smutylo, Andre Lafleche, John Marotta and Hugh Hamish Sutherland. Select biographical details regarding Messrs. Marotta, Smutylo, Lafleche, Marotta and Sutherland can be found in the Filing Statement. The Company is also pleased to announce the appointment of Mr. James Yersh to the Board of Directors, where he will take over the role of Audit Committee Chair. Mr. Yersh is currently the CFO and EVP of Corporate Development at KORE Telematics and was previously CFO of Blackberry. Mr. Yersh brings with him a wealth of experience in corporate governance, and financial reporting and oversight.

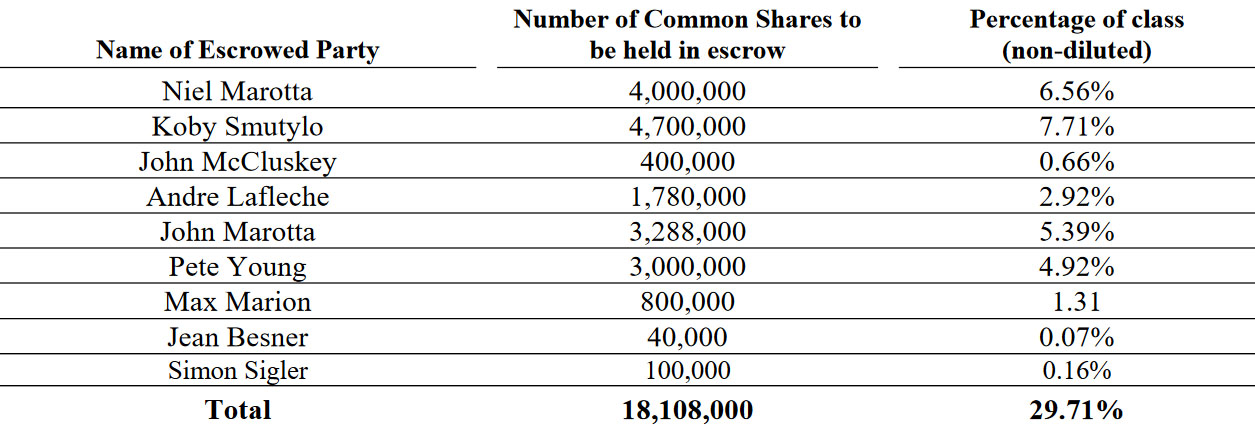

Escrowed Securities

The Company wishes to update the escrowed securities table included in the Filing Statement. Upon completion of the Acquisition, 18,108,000 Common Shares of the Company are subject to a Tier 1 Value Security Escrow Agreement, as follows:

Additionally, following completion of the Acquisition, 12,800,000 Common Shares will be subject to a 4 month Exchange hold, and 680,000 Common Shares will be subject to one year Exchange hold pursuant to Exchange Policy 5.4.

Option Issuance

The board of directors of the Company has authorized the grant of 2,480,000 incentive stock options to certain of its directors, officers, employees and consultants. Each such option entitles the holder to acquire one Common Share for a period of five years at an exercise price of $0.75 per share. The options are subject to vesting over the course of 24-36 months following the grant date.

Listing

The Company has obtained final approval to list its common shares on the TSXV as a Tier 1 Industrial or Life Sciences Issuer. The common shares are expected to begin trading on the TSXV at the opening of markets on or about December 19, 2017 under the symbol “NDVA”.

About INDIVA

INDIVA is a Canadian supplier of high quality, medical grade cannabis. INDIVA’s strain selection, cultivation and client care processes combine the know-how and experience of an internationally recognized and award winning grow-team with GMP-compliant quality assurance standard operating procedures.

INDIVA’s wholly owned subsidiary is a Licensed Producer under Canada’s Access to Cannabis for Medical Purposes Regulation (“ACMPR”) with its first indoor cannabis production facility located in London, Ontario.

INDIVA aims to become a global marijuana brand recognized for high quality cannabis products and excellent client care. As marijuana laws liberalize in Canada, INDIVA will expand its product offering to include safe edibles and other client-friendly cannabis products. In addition, as marijuana laws liberalize internationally, INDIVA will use its Canadian operations as a platform to open new markets for its cannabis products.

CONTACT INFORMATION

INDIVA

Niel Marotta, CEO

Phone: 613-883-8541

Email: [email protected]

DISCLAIMER & READER ADVISORY

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has in any way passed upon the merits of the Transaction and neither of the foregoing entities accepts responsibility for the adequacy or accuracy of this release or has in any way approved or disapproved of the contents of this press release.

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words “could”, “intend”, “expect”, “believe”, “will”, “projected”, “estimated” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the parties’ current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to the intention of the parties to complete the Offering and the Transaction. Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to the parties. The material factors and assumptions include the parties being able to obtain the necessary corporate, regulatory and other third parties approvals; licensing and other risks associated with regulated ACMPR entities; and completion of satisfactory due diligence. The forward looking information contained in this release is made as of the date hereof and the parties are not obligated to update or revise any forward looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. Not for distribution to U.S. Newswire Services or for dissemination in the United States. Any failure to comply with this restriction may constitute a violation of U.S. Securities laws.